How are you feeling about this year’s elections?

If the thought of it makes your heart beat faster––you’re not alone.

Most United States residents across party lines experience major stress around presidential elections.1

And recently, that stress has skyrocketed.

In 2016, about 1 in 2 people said they were stressed out and anxious about the presidential election. And by 2020, more than 2 in 3 people were feeling election stress.1

Why?

Political hostilities and increasing divides on party lines are partly to blame.1

So is the uncertainty of it all.

It can be overwhelming and really exhausting not knowing how an election will shake out or if things will go the way we want. That uncertainty can invite worst-case thinking that stokes our deepest fears.1, 2

And, unfortunately, all of that isn’t limited to who wins the White House. An election year can raise real concerns about market trends and our finances.

In fact, about half of us are worried about how the 2024 elections will affect our portfolios.3

Are those fears valid?

Does a presidential election year cause market instability? And is that instability based on a Democratic or Republican win?

Here are a handful of facts about the markets in and around presidential election years.

The Stock Market & Presidential Elections: 5 Fascinating Trends from the Last 100 Years

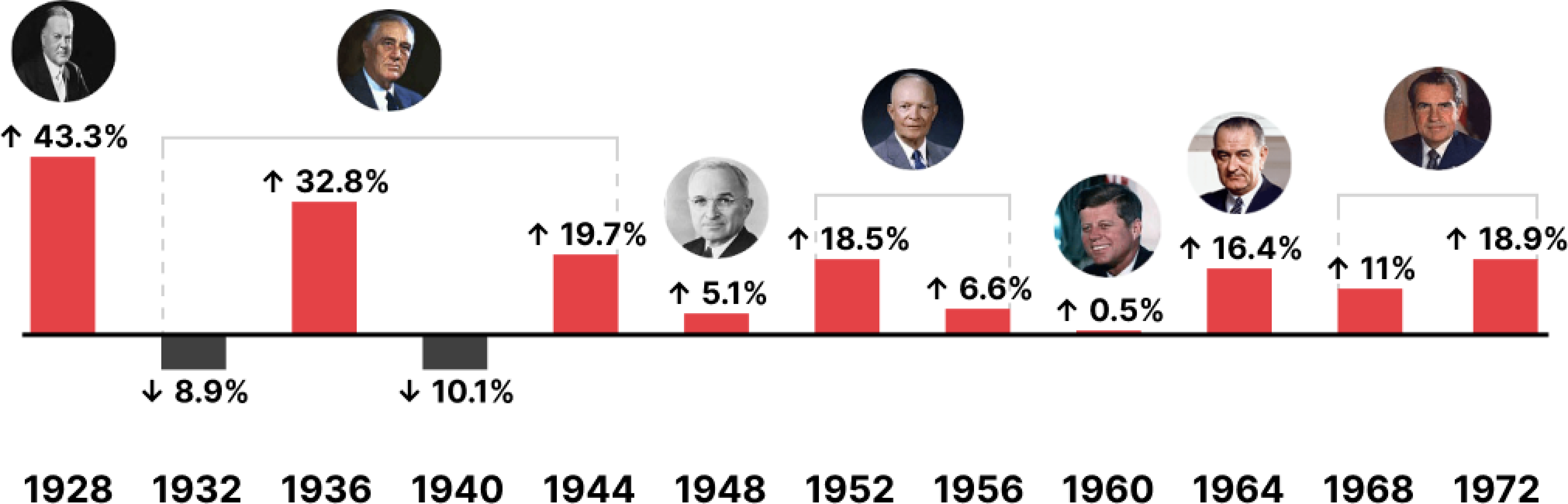

Trend 1: Most election years see positive returns in the stock market.

Over the last century, we’ve had 24 presidential elections. In 82% of those elections, the stock market has seen positive returns. That means only 18% have had negative results.4

The graphs below show the average stock market returns for each of the 24 different presidential years over the last century.4,5

Average S&P Returns for the Election Year

Part 1 | Election Years 1928-1972

Part 2 | Election Years 1976-2020

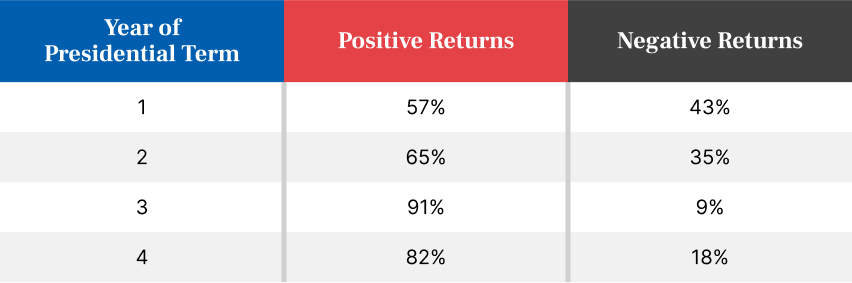

Trend 2: Most positive market returns tend to appear in the 3rd year of a presidential term.

Year three after a presidential election tends to be associated with the strongest market performance. In fact, about 91% of the time, year 3 in a presidency has positive market returns.4

That may be tied to the fact that year 3 is when early years’ work, like newly written legislation, is finally passed. It can also be when a president starts thinking about reelection and setting the stage for campaign strategy.

Here’s how market returns have generally fared in each year of a presidency over the last century or so.4

Trend 3: Average returns tend to be higher with Republican electees.

S&P returns tend to be lower with a Democrat elected to the Presidency versus a Republican. In fact, as the table below shows, positive returns tend to double when Republicans are elected as president.6

Notably, positive returns tend to occur regardless of party affiliation—and it does matter who controls Congress.

That’s because the markets don’t typically like one party to sweep the Presidency and Congress, with either Republicans or Democrats controlling it all. That tends to cause short-term volatility. Instead, the markets usually prefer checks and balances and the stability of divided government.7

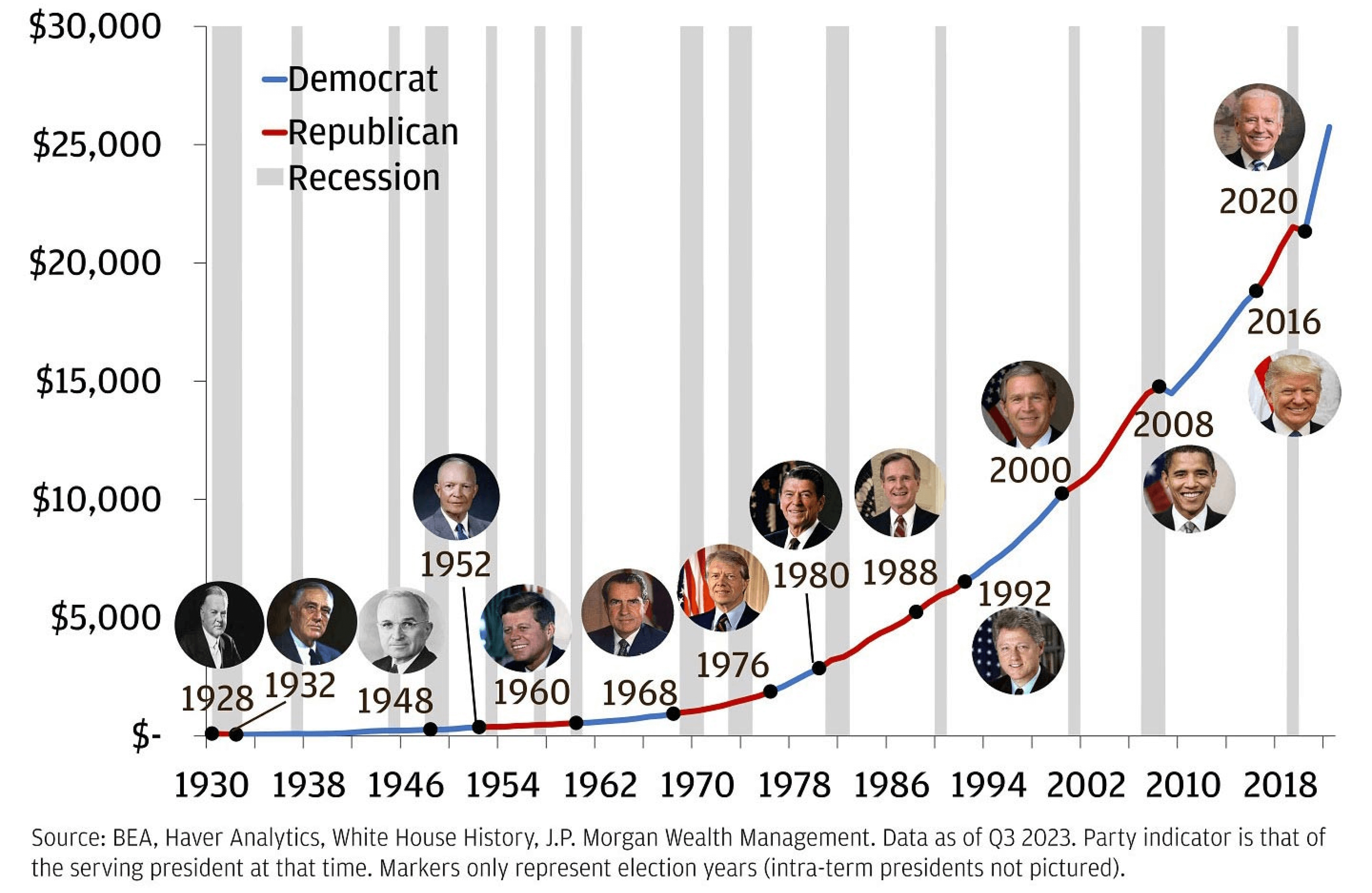

Trend 4: Republican or Democratic President, the economy continues to grow.

Political passions and parties aside, the U.S. economy has grown over the last century, regardless of whether a Republican or Democrat is sitting in the White House. That’s meant trillions in economic growth, making the U.S. economy the largest in the world—despite party affiliations and political divides.8

The U.S. economy has continued to grow regardless of who is in the White House

U.S. Nominal Gross Domestic Product (GDP), USD billions

Trend 5: Nothing’s 100% certain.

In elections and the markets, there are no absolutes or certainties. Several diverse and highly complex factors from inflation and recessions to conflict abroad, unrest at home, and more can affect market activity and how elections unfold.

As helpful as trends and forecasting may be, remember, nothing’s set in stone until it actually happens. So when it comes to both elections and the markets––your choices matter.

Truth is, both elections and the markets can come with built-in uncertainty. And that’s OK.

FINANCIAL LESSON:

How to Make Better Financial Choices During an Election Year

Did you already know any of those facts about elections and the markets?

Which one(s) surprised you the most?

No matter how you answer those questions, the truth is both elections and the markets can come with some built-in uncertainty. And that’s OK.

Still, both elections and the markets run on cycles. And no two cycles in either area ever look exactly the same.

Why?

Because countless factors affect elections and the markets.

And it’s not just about political parties and who wins the Presidency. Current events, foreign policy, and so much more can come into play.7

Trying to account for it all can be dizzying.

It can also get in the way of prudent choices, especially if we end up trying to time the markets or make money moves based on political preferences or predictions.

That’s why it’s important to focus on the facts—and have some simple strategies for dealing with election stress and market turbulence.

To do that, you can start as simple as limiting your media intake and time on social media around elections. You can also steer clear of political talk or debates, even with those who are “on the same side” as you.

With that, it also helps to keep your eyes on the big picture and check in with the people you trust.

When you do, you can get a fresh perspective and invaluable advice for weathering the next political storm or any volatility in the markets.

- https://www.apa.org/news/press/releases/2020/10/election-stress

- https://www.usatoday.com/story/news/politics/elections/2020/11/07/election-stress-race-over-but-now-nation-looks-normalcy/3755002001/

- https://www.cnbc.com/2023/11/13/investors-fear-the-2024-elections-may-hurt-retirement-savings.html

- https://www.visualcapitalist.com/u-s-stock-market-perform-election-years/

- https://www.slickcharts.com/sp500/returns

- https://advisor.morganstanley.com/the-ernie-garcia-group/documents/field/e/er/ernie-garcia-group/S%26P%20500%20in%20Presidential%20Election%20years.pdf

- https://www.usbank.com/investing/financial-perspectives/market-news/how-presidential-elections-affect-the-stock-market.html

- https://www.jpmorgan.com/insights/outlook/market-outlook/2024-elections-3-thoughts-on-the-year-ahead

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.